Case Studies

CEO of MNC

The CXO of a top MNC decided to relocate to India for family related reasons. Back home, instead of continuing his corporate career in a new environment, he wanted to pursue his long-standing passion for travel writing. He had enough savings to support his desired lifestyle. However, as most of his nest egg was invested in real estate, it did not give him the required level of regular income.

Our solution was to transform his portfolio by selling most of his real estate holdings and investing in financial assets. He achieved the desired level of liquidity by earning a real return (net of inflation) of over 5% on his financial assets while living in his only remaining property.

HE HAS FINALLY BEEN ABLE TO PURSUE HIS PASSION

CEO of Large Tech Company

The CXO of a top 5 software services company had reached financial independence with a net worth of 10+ crore, which was primarily locked up in stock options. His confidence in his company and his ability to influence its performance had made him hold on to those options.

Our solution was based on the rational that he would continue to do well if his company did well, but he needed to de-risk his portfolio by reducing the disproportionate weight of stock options. So, we transformed his portfolio by selling the vested options and redeploying the proceeds in diversified assets. Eventually the value of the remaining options went down significantly due to a downturn in the sector but he was safe with his diversified portfolio.

OPTIONS ARE NOT DOING WELL BUT HE SLEEPS WELL

CXO Aspirant Young Couple

This young couple started promising careers post MBA from a top institute. They were planning to buy the flat they rented with their initial corpus of wedding gifts and savings. The wife planned to take a break after 5 years to raise a child. Their goal was to attain financial independence by 40 and launch their own start-up.

While the conventional wisdom was to first buy their house, our solution was to first invest in financial assets to accumulate enough capital to generate returns matching their current earnings. Without the interest burden of EMIs, their financial assets are growing at a fast pace and they are on track to start their dream venture.

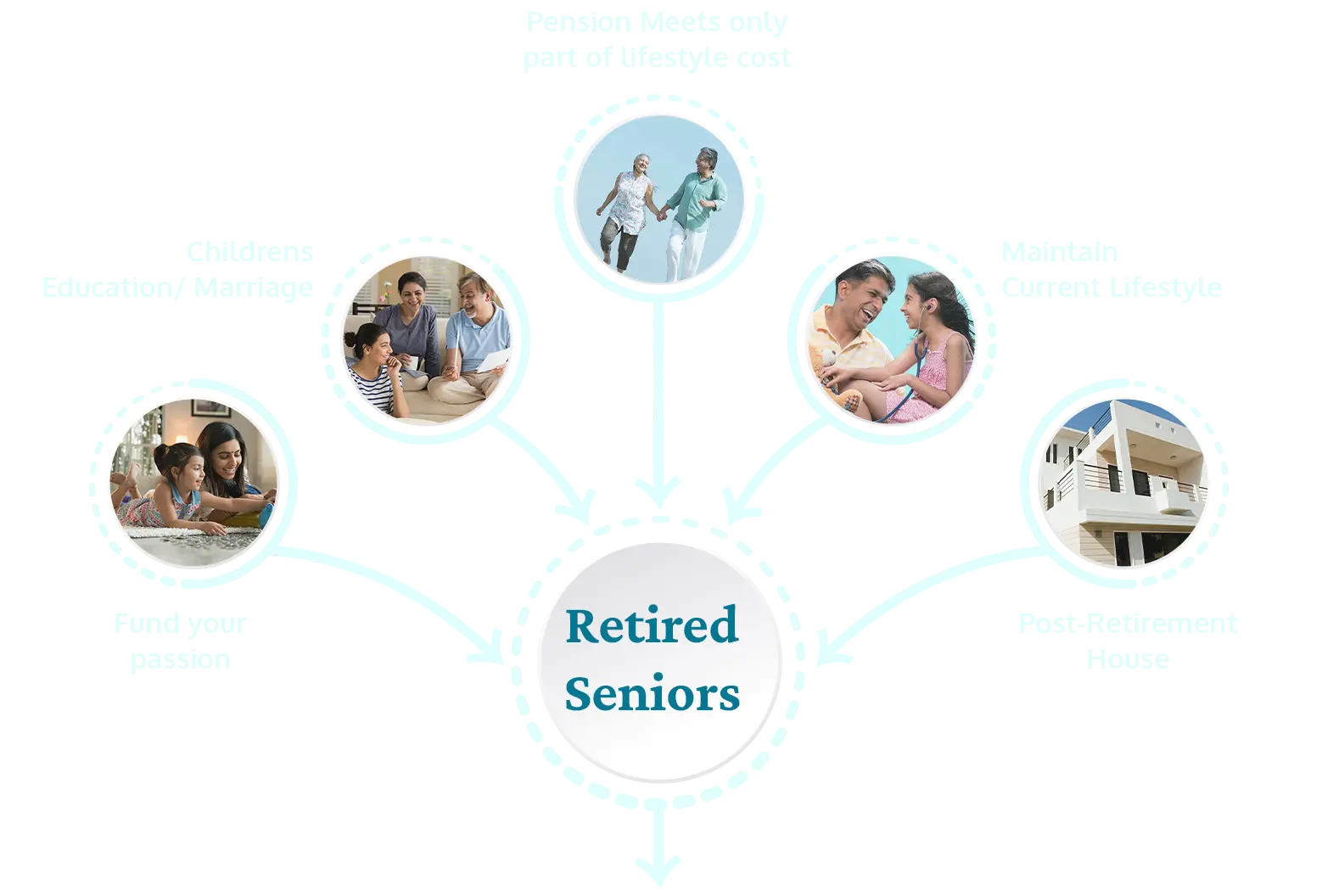

Case Studies

IAS Officer

The senior bureaucrat decided to settle in Goa after retirement. He owned 2 flats in Delhi and inherited properties in his hometown.

However, his pension covered only 40% of his living expenses and the rental return of 2% from his properties was not sufficient to cover the gap.

Following our advice, he sold all his real estate and bought a retirement home in Goa and invested the balance in a diversified portfolio of stocks & bonds. He has now achieved financial independence and draws a monthly amount from the returns on his portfolio to supplement his pension and maintain a comfortable lifestyle.

PSU Manager

The client retired as a General Manager from one of the largest PSUs which does not have a pension scheme. He owned 3 flats and received a lumpsum amount on his retirement. He was also paying EMI for one of the properties.

We advised him to sell one apartment to double his investment corpus and invest in a balanced portfolio of stocks and bonds after paying off his home loan.

He has attained financial independence with a monthly drawdown from his portfolio and rental income from one apartment while staying in the other.

92 Years Old Widow

The lady who preferred to live independently after her husband passed away was financially secure with a large portfolio of FDs and equities and her own property to stay in.

We ensured that her wealth is well invested in a diversified and conservative portfolio to take care of her needs and to grow and pass it on to the next generation. To that end we drew up and executed a regular pension plan and a succession plan of her assets to her 2 daughters and their children as well as adequate compensation plan for her caregivers as per her wishes.

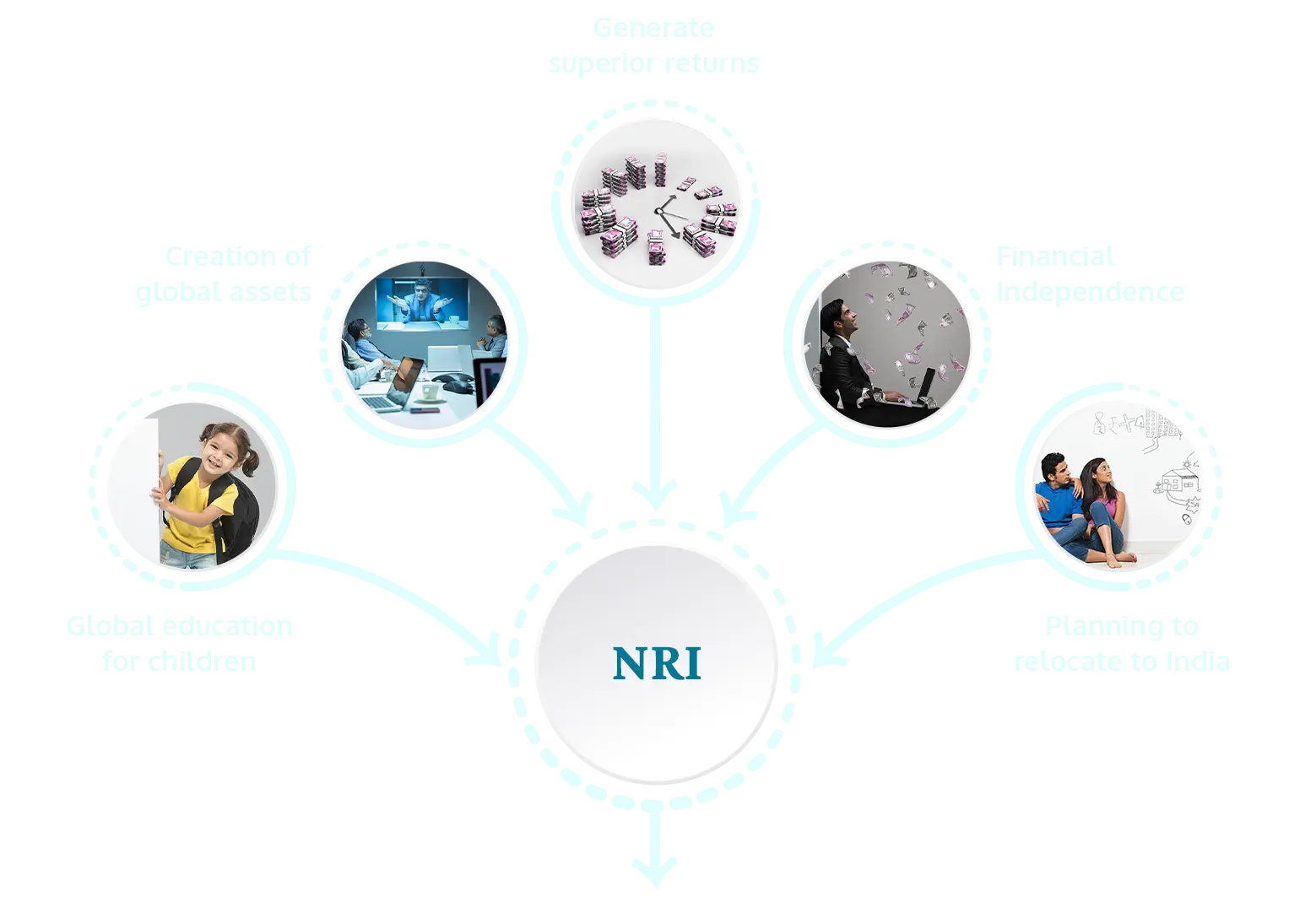

Case Studies

Singapore NRI

The 50-year-old IIT / IIM alumni relocated to Singapore as CEO of a mid-sized IT company. He planned to return to India after 3-5 years after building up his savings corpus.

His key challenge was to manage his real estate assets in India and ensure regular rental income in a secured manner. He also needed help with managing his financial assets in a tax compliant manner.

Our solution was to reduce his real estate holdings to just one unit for post-retirement self-occupancy. We also improved and de-risked his investment portfolio returns by going overweight on long duration bonds and cyclical stocks and being underweight on the IT sector as a diversification strategy in view of the large stock options he held in his company.

US Citizen

The dependent parents of the USA based IT professional preferred to return and settle in India.

We helped plan out their investment portfolio to ensure adequate returns to maintain their lifestyle and healthcare costs. They live in their own house and we recommended investing their savings into a diversified portfolio of stocks and bonds. The returns from the portfolio with a monthly withdrawal plan, supplemented by remittances from their son to meet large expenses like travel etc., as and when required, has enabled them to maintain a comfortable lifestyle in India.

Case Studies

Metro Based Specialist Doctor

The 48 years old medical specialist with a thriving private practice sought our help to plan his finances to meet his financial obligations and save for his retirement.

He had high monthly earnings but most of his savings were tied up in real estate with low single digit returns. He wanted to build a corpus to finance the higher education of his 2 children abroad and to also set aside some investments to take care of his deceased brother’s family.

We advised him to rationalize his real estate holdings and created separate portfolios of financial assets dedicated towards his children’s education, support for his brother’s family and retirement savings for himself.

Doctor Couple Planning Own Nursing Home

The 52 years old surgeon retired from the defence services and joined a large hospital chain with an attractive package. His wife was also a successful medical practitioner attached to another hospital.

They aspired to start their own niche nursing home with surgical facilities in 3-5 years.

Our solution started with investment of retirement corpus in a diversified portfolio of financial assets and monthly investment of high savings in a similar portfolio. The power of compounding should help them meet the capital required for their project as per plan.

Family Enterprise Owner - Tier 1 City

This IIT / IIM graduate had taken the reins of and turned around his family enterprise to run it profitably for 30+ years. He had successfully built up a high net worth both for his family and his business entity.

Both his children were well qualified but were not interested in joining the family business. He had to therefore plan for a successful exit from his business in the next 3 to 5 years.

We manage his financial portfolio with a diversified asset allocation to protect his capital and give an attractive but risk averse return. We have also advised him on planning the divestiture of assets in the books of his business in a tax efficient manner and preparing for an eventual profitable exit.

Publishing Business Owner

The 65 year old owner of a long standing and reputed publishing business in a tier 2 city had the twin goals of achieving financial independence and transforming his business which was facing an existential threat from new technology and the need for next generation leadership.

The family had also invested heavily in real estate and depended on regular rental income arising from them. However, diminishing returns from both business and rental income threatened their financial independence.

We offered our PMS solution to rebalance their portfolio and manage their wealth to generate the required liquidity to achieve financial independence. We also provided business transformation consulting to redefine their business strategy, business processes & IT systems and motivated and mentored the next generation leadership to take over the reins and ensure continuity of the business.

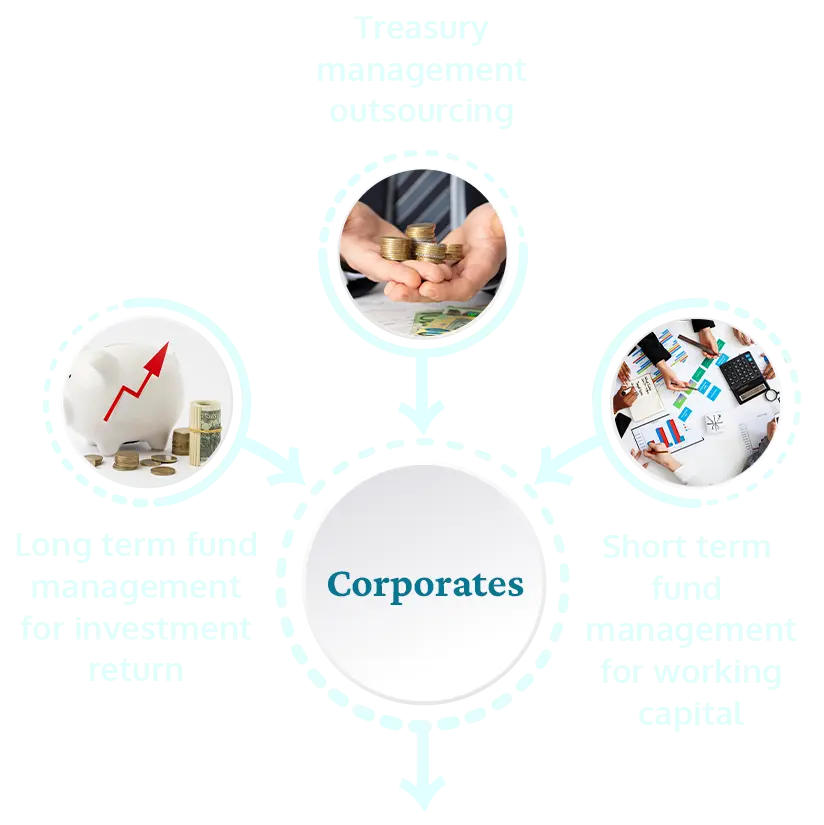

Case Studies

Treasury Management Outsourcing for Cash Rich SME

This cash rich SME had parked their significant cash surplus in current accounts and short duration FDs which were giving low returns. They were not large enough to have in-house treasury management and were looking for outsourced help to manage these funds more efficiently. They wanted 10% of funds to be available to them on 48-hour notice. The rest could be deployed on a more long term basis.

Our solution separated the overall corpus into two categories. We deployed the emergency working capital component in short duration debt funds which could meet their liquidity needs. For the balance we designed a long term portfolio of blue chip stocks and high quality bonds to give higher returns with enough built-in safety and liquidity.

COMPLETE TREASURY MANAGEMENT OUTSOURCING AT AFFORDABLE COST

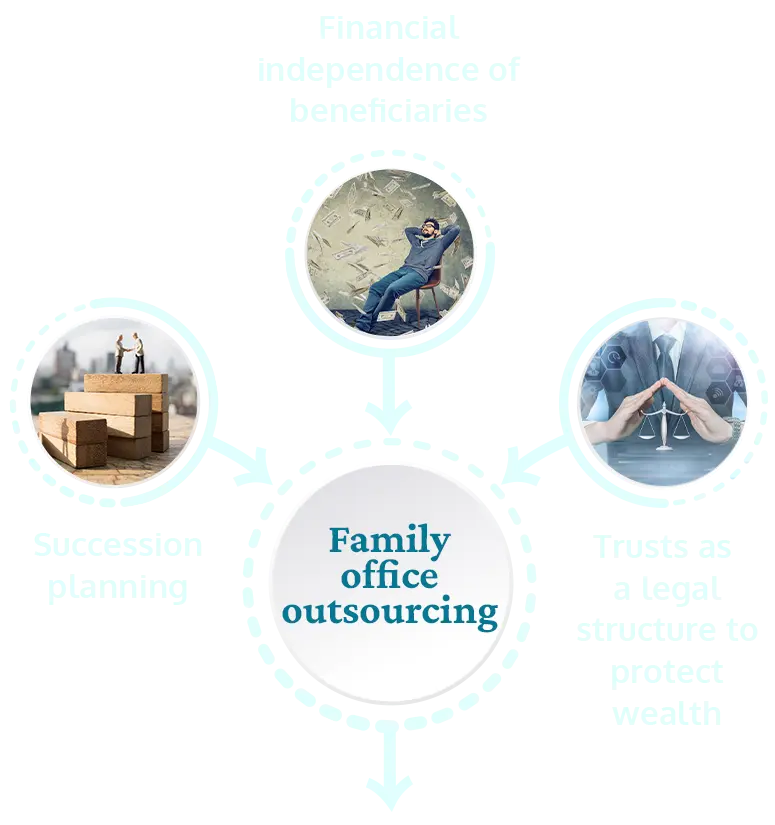

Family Office Outsourcing

The retired high net worth individual (HNI) with no immediate family was devoted to social work. He needed a regular income to cover his living expenses and wanted to ensure that his wealth was donated to specified social initiatives during his lifetime and after his death.

Our solution was to create a family trust to hold his inherited wealth and deploy it in a balanced portfolio of equity and fixed income securities. It provides regular income to him as a beneficiary to meet his living costs and one-off requirements like travel and healthcare. The trust deed ensures that regular donations are made to his specified charities from the fund during his lifetime and which will be continued even after his death.

FAMILY OFFICE OUTSOURCING AT AFFORDABLE COST